Usage-Based vs. Outcome-Based Pricing for APIs

Usage-based pricing has long been the default for APIs—straightforward to implement and easy for customers to understand. You charge based on consumption: API calls, compute time, or data volume. It is predictable, measurable, and scales well with usage.

But as APIs become more intelligent—especially in AI-driven platforms—raw consumption no longer remains a reliable proxy for customer value. A user can rack up thousands of API calls and still achieve nothing meaningful. Meanwhile, a single well-placed call might generate a qualified lead or close a sale. Usage-based models fail to capture that difference.

This gap is fueling a shift toward outcome-based pricing—where customers pay for results, not requests. In this article, we will explore how this shift is redefining API monetization, what product teams need to consider, and how to instrument outcomes effectively using platforms like Moesif.

Table of Contents

- What is Usage-Based Pricing?

- What is Outcome-Based Pricing?

- The Shift Toward Outcome-Based Pricing Model

- How Outcome-Based Pricing is Changing API Monetization

- How to Meter Outcomes Inside Your API Product

- Conclusion

What is Usage-Based Pricing?

In a usage-based pricing model, customers pay in direct proportion to the resources or services they consume. In the context of APIs, this usually translates to billing by units such as the number of API requests, data volume, compute time, or generated tokens. It is a simple model to implement because every interaction leaves a measurable trace. Platforms like Moesif make it easy to collect, aggregate, and bill on usage metrics with minimal friction.

The usage-based approach gained popularity during the rise of cloud computing and API-first platforms because it aligned well with infrastructure cost curves. If a service incurred costs per request or CPU cycle, it made sense to bill customers accordingly. It was also flexible—users paid only for what they used, which made it appealing to startups and developers experimenting with low-scale use cases.

However, usage-based pricing models assume that resource consumption is a proxy for value delivered. That assumption holds in some infrastructure scenarios, such as object storage or serverless computing. But it starts to break down when you apply it to APIs that deliver business logic, intelligence, or end-user experiences. In those cases, the same usage pattern can result in wildly different levels of value across customers—yet the pricing remains fixed to units of activity instead of outcome.

It is also worth noting that usage-based billing has deep integrations into many SaaS and cloud pricing structures, from Twilio (per message) to OpenAI (per token) to AWS Lambda (per millisecond). While this consistency makes it easy to adopt and standardize across services, it also locks platforms into a mindset where activity equals value—a mindset increasingly at odds with modern product strategy.

What is Outcome-Based Pricing?

Outcome-based pricing model charges customers based on the results they achieve instead of the infrastructure they consume. Unlike usage-based models that count API calls or compute time, outcome-based models focus on metrics like verified leads, successful transactions, resolved support cases, or other domain-specific signals that reflect real business value.

This approach shifts metering from backend activity to customer success. Instead of tallying HTTP requests, product teams define and instrument events that signify meaningful outcomes like a completed shipment. These metrics live closer to the customer’s goals and require careful design across application logic, analytics, and identity systems to ensure traceability.

The model appeals to both vendors and buyers. Product teams align revenue with actual impact, rather than chasing higher request volume. Buyers gain confidence that they only pay when the product works as intended. This alignment reduces billing friction, especially in complex sales environments where finance teams demand justification tied to performance rather than traffic.

AI and ML platforms, in particular, highlight the limitations of usage-based pricing. Two identical inference calls may yield vastly different outcomes—one helpful, one irrelevant. Treating them equally in pricing overlooks the variability in value delivery. By adopting outcome-based pricing models, vendors can define success—for example, relevancy thresholds, user engagement with outputs, and price accordingly. This allows the vendors to reward accuracy and effectiveness instead of volume alone.

This pricing strategy requires more than a billing tweak—it demands deep observability across user flows and a reliable method to attribute outcomes to specific product interactions. Without that instrumentation, outcome-based pricing lacks the data to function. But for teams who invest in this infrastructure, the payoff includes clearer ROI, better customer alignment, and pricing models built around value instead of volume.

The Shift Toward Outcome-Based Pricing Model

Market dynamics, rising operational costs, and advances in observability have exposed the limitations of usage-based models—especially for AI, data, and workflow-centric APIs. Let’s break down the core forces accelerating the shift toward outcome-based pricing.

Infrastructure Costs Have Become Outcome-Sensitive

The rise of AI APIs has transformed cost dynamics. A single API call might trigger inference on a billion-parameter model, consume GPU clusters, or hit third-party inference providers like OpenAI—all in seconds. These costs vary widely and accumulate fast. Usage-based models, which bill per request or per token, often ignore the value produced by that request. One user might trigger thousands of costly operations that produce zero business impact. Product teams now face pressure to design pricing that scales with actual outcomes besides usage volume.

Finance Teams Demand Value Justification

CFOs and RevOps leaders no longer accept pricing strategies based solely on traffic or activity. They expect clean, traceable connections between what the product costs and what the customer gains. Outcome-based pricing model supports this expectation by tying revenue to measurable performance metrics like cost-per-lead, transaction completion rates, or user activation. These models offer better alignment between product performance and financial accountability—something increasingly necessary in long sales cycles or enterprise contracts.

Instrumentation Tools Enable Outcome Tracking

Until recently, outcome-oriented models felt aspirational. Teams lacked the observability to measure what really mattered to customers. But the tooling landscape has matured. Platforms like Moesif allow teams to automatically collect user behavior events, define custom success metrics, and analyze conversion paths in real time. These capabilities enable developers and product managers to instrument outcome events—like successful transactions, lead captures, or model-generated completions—and tie them back to individual accounts or usage patterns. Without this visibility, pricing for customer outcomes would remain impractical.

Contextual APIs Reinforce the Value Shift

With the emergence of protocols like MCP (Model Context Protocol), API interactions now include more structured and intention-aware context. Instead of sending raw prompts or stateless calls, clients now inject metadata—user goals, session history, environmental parameters—that shape the model’s response. This structure makes outcomes more predictable and measurable, enabling pricing strategies that charge based on what the model achieves, not how many tokens it consumes. Context-rich APIs support outcome-aware pricing by design.

These forces converge to push API businesses away from measuring activity and toward measuring accomplishment. Outcome-based pricing lets product teams monetize based on what customers actually achieve—better aligning revenue with customer satisfaction, retention, and long-term value. It also helps product teams escape the volume trap: more usage doesn’t always mean more value. Measuring and monetizing outcomes creates a path to healthier, more sustainable growth.

How Outcome-Based Pricing is Changing API Monetization

Adopting outcome-based pricing changes what you charge for. It also redefines how teams think about value, accountability, and product instrumentation. In this section, we examine how monetization strategy evolves when pricing aligns with results instead of requests.

From Metering Activity to Mapping Value

Traditional API monetization strategies rely on request logs and resource counters. With usage-based pricing models, billing systems track volume. Here are some usage-based pricing examples:

-

How many requests a user makes

-

How many seconds of compute they consume

-

How many tokens they generate

This works well for infrastructure providers but limits flexibility for APIs delivering domain-specific intelligence or workflow automation. On the contrary, outcome-based pricing models force teams to identify and measure value-producing events. This change reorients the entire monetization layer—from what you log, to how you interpret those logs and link to billing logic.

Business Logic Now Drives Billing Logic

In outcome-based models, product teams must define pricing rules around real-world success events, for example:

-

A package delivered

-

A fraud attempt caught

-

A support ticket resolved

These events often live outside the scope of the API gateway. Billing systems no longer plug directly into the infrastructure layer—they depend on custom instrumentation within the application code. This increases the complexity of billing design but allows teams to charge in ways that reflect how their product creates value. Engineering teams must collaborate closely with product, finance, and customer success to define what counts as an outcome and how to track it reliably.

Monetization Moves Closer to Product Analytics

As outcome-based models mature, the monetization stack starts resembling the product analytics stack. API providers now require event-driven logging, identity resolution, and conversion tracking—not just request counts. Platforms like Moesif bridge this gap by enabling teams to define behavioral events, track user journeys, and connect those outcomes to billing triggers.

For example:

-

A logistics API might charge based on the number of deliveries completed within SLA.

-

A voice transcription API could price per call recording that achieves >95% transcription accuracy.

-

A fraud detection API may bill per distinct fraudulent transaction blocked before execution.

-

An AI summarization API might charge only when users rate the generated summary above a relevance threshold—or when customers click to expand or use that summary downstream.

-

A fintech compliance API might charge per unique transaction flagged and confirmed as suspicious rather than per rule evaluation.

These pricing models reflect how customers experience value rather than how many times they hit an endpoint. That shift requires teams to treat outcome instrumentation as a core layer of their product and revenue infrastructure.

Impact on Sales, Customer Success, and Support

Outcome-based pricing reshapes how go-to-market teams communicate value and measure success.

Sales teams must position pricing around business outcomes rather than usage tiers. Instead of selling “X API calls per month,” they anchor conversations in metrics like cost-per-verification or successful fraud interventions in sales processes.

Customer success teams focus on enabling outcomes besides onboarding. They guide customers toward measurable milestones that affect billing—like increasing conversion rates or reducing time-to-resolution.

Support teams address more than technical issues. They help surface value delivery gaps, such as low-quality AI responses or silent workflow failures that prevent outcomes—even when usage appears normal.

Each team contributes to ensuring that customers use the product and succeed with it. Outcome-based pricing makes that alignment measurable, cross-functional, and central to revenue growth.

A More Accountable, Value-Aligned Revenue Model

API providers that adopt outcome-based pricing improve their ability to retain and grow accounts. Customers gain visibility into what they pay for and why. Vendors can justify pricing with clear, product-driven metrics—contributing directly to stronger net revenue retention over time. As pricing and revenue models shift toward value alignment, teams gain leverage to optimize for outcomes, avoid usage data noise, and build long-term monetization strategies that scale with customer impact.

How to Meter Outcomes Inside Your API Product

Designing outcome-based pricing starts with identifying what success looks like for your customers. Then you have to build the instrumentation to track those signals reliably. Unlike usage-based models that rely on infrastructure metrics like API call counts, outcome-based pricing requires observability at the business logic level.

1. Define Outcome Events That Reflect Value

Start by identifying key product actions that map directly to tangible value creation. For example, in a fintech API, this might mean:

-

A verified transaction

-

A loan approval

-

A successful fraud alert trigger

For an AI API, relevant outcomes could include the following:

-

Documents queried and rated above a quality threshold

-

Generated content was factually correct

-

Completed workflows with positive outcome

These outcome events form the core billing units in an outcome-based pricing model. They should reflect customer value clearly enough that sales, success, and finance teams can all agree: this event matters.

2. Instrument Outcomes

Once you define your value events, use Moesif’s API monetization platform to track outcomes. For APIs, Moesif has integrations with most API gateway and management vendors making setup super quick.

Since Moesif captures raw API calls with granular context, including payload and metadata, you can easily define a billable metric that reflects the outcome you want to charge for.

You cannot determine all outcomes from API traffic. For tracking custom outcomes, you can leverage Moesif’s custom actions—for example:

-

Data Processing Job Finished

-

Generated Qualified Lead

As part of the action, you should track the result such as score or quantity as part of metadata. This enables you to filter, group, and visualize them across customers, making them ideal for outcome-level analytics.

3. Create Billing Meters for Outcome-Based Models

Moesif’s monetization features allow you to set up billing meters in a few clicks to bill on outcomes and results. Moesif has out-of-the box integrations with popular billing providers like Stripe, Chargebee, and Zuora.

You can meter specific events or track filtered subsets. Once the outcome data flows into your billing provider, it powers pricing plans based on actual results—aligning charges with business impact instead of infrastructure usage.

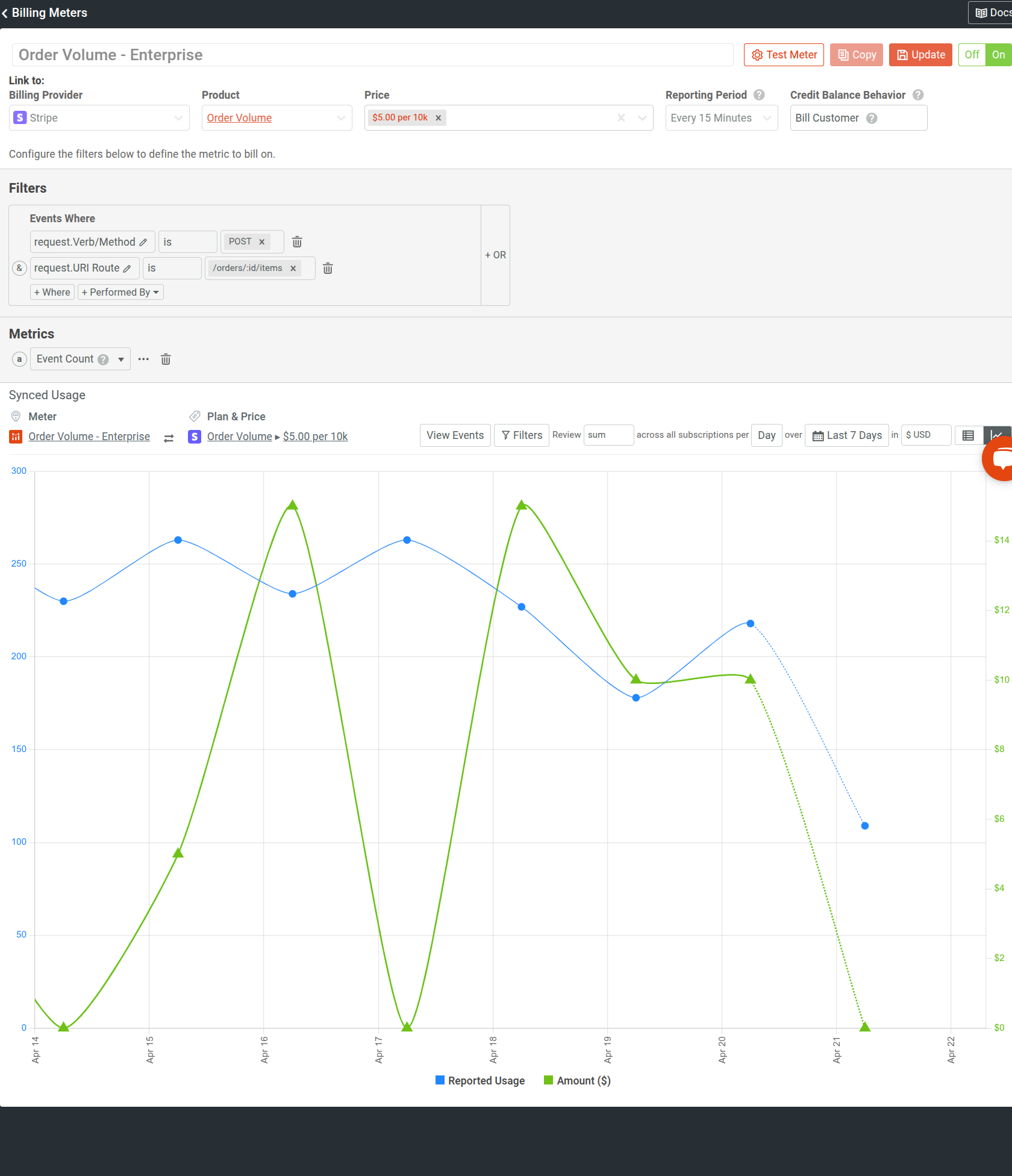

For example, the following billing meter in Moesif charges as the percentage of order volume in a logistics API:

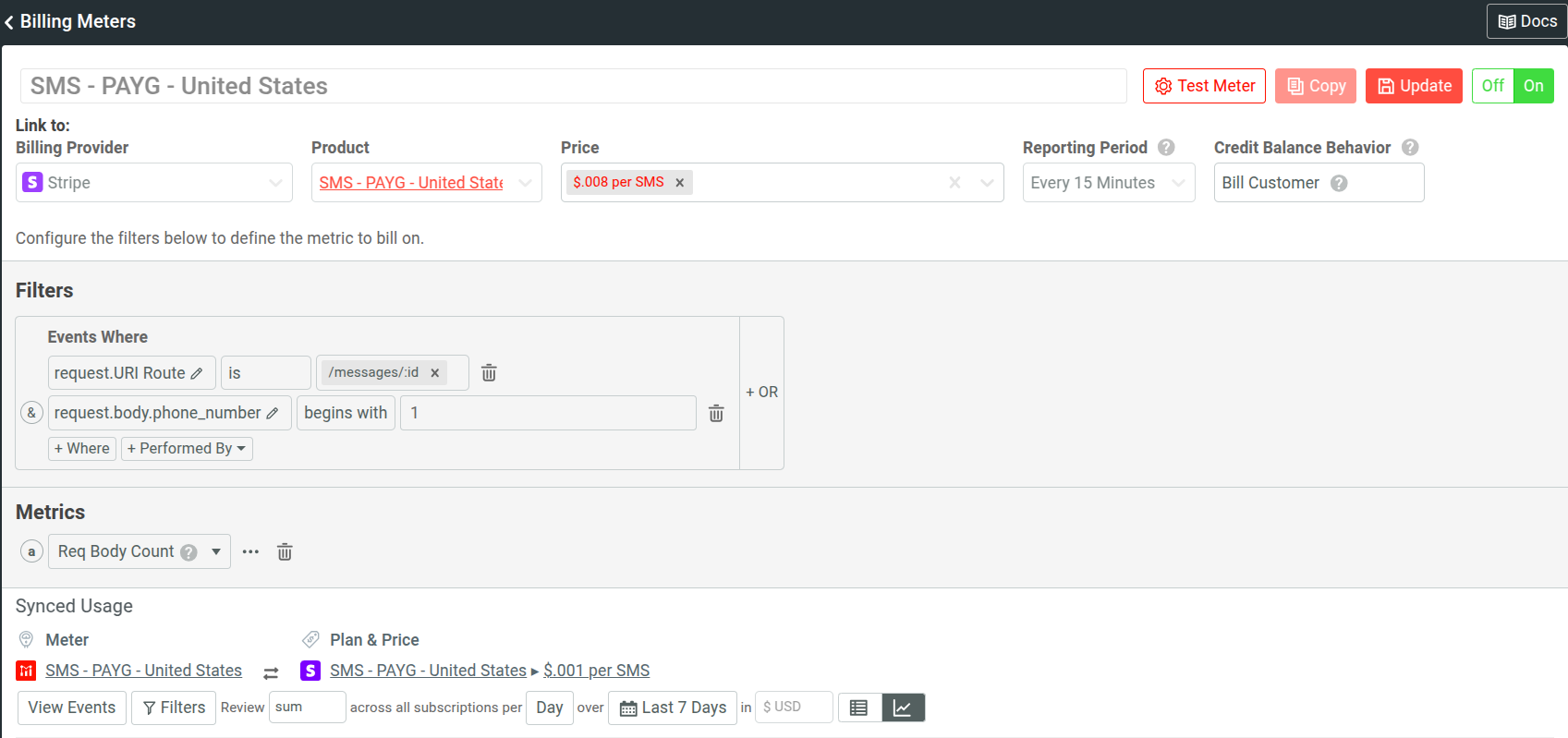

The following illustrates a billing meter for a telecommunications company. It defines the billable metric as the number of people receiving text messages by counting the number of request body fields.

4. Monitor and Improve Outcomes

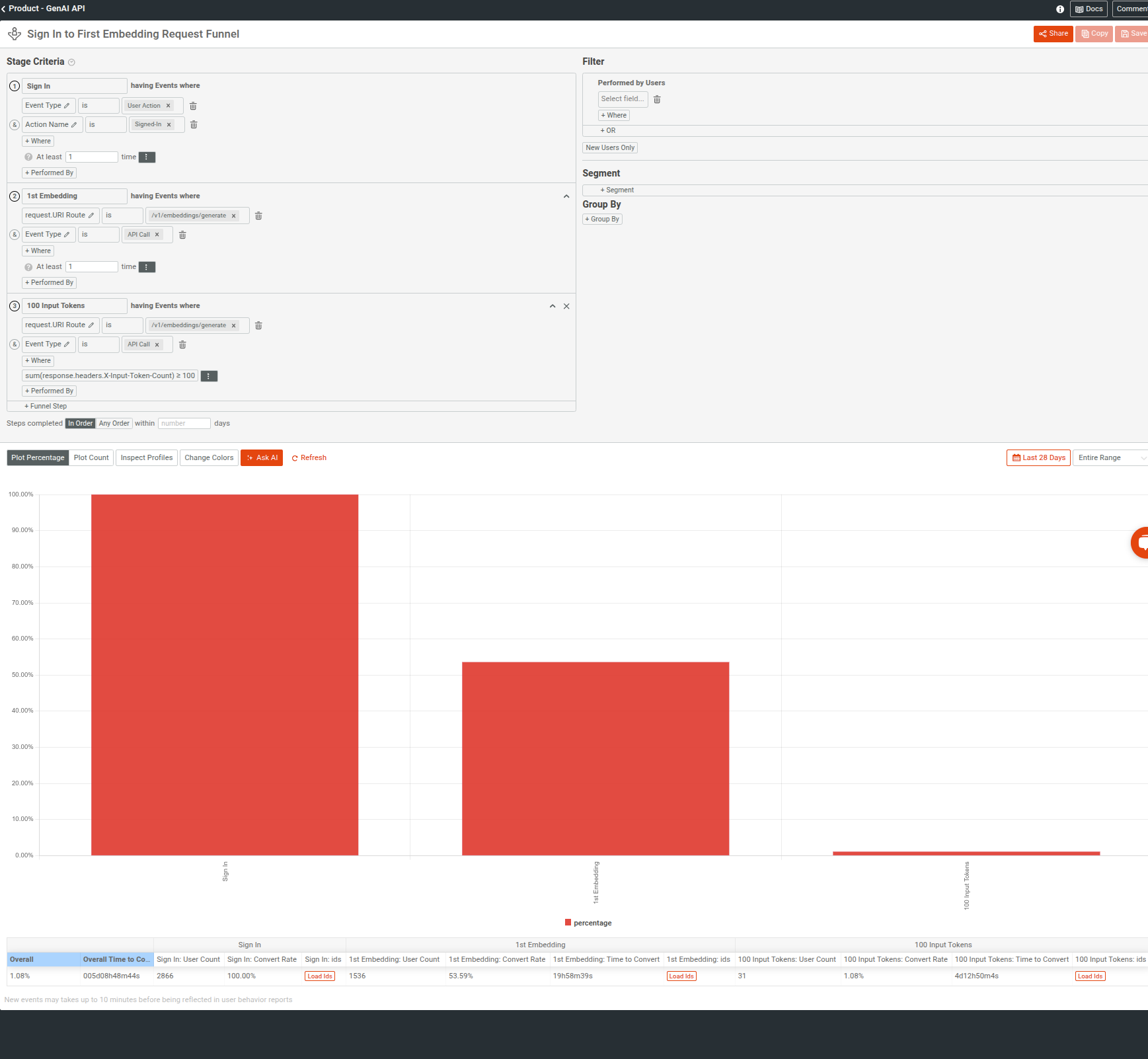

Tracking outcomes requires full lifecycle visibility. To do this, you can build a funnel report to understand your customers’ journey as they use your product to reach desired outcomes, and pinpoint where they drop off. For example, the following funnel analysis in Moesif analyzes customer journey for an embeddings API by defining these steps:

-

First sign-in

-

First request to generate embeddings

-

100 input token consumption

Moesif also provides tools like retention charts to analyze customer retention and time-series breakdowns to monitor how users move from raw API calls to meaningful results. For example, a product team can measure time-to-first verified transaction or drop-off rate from API call to completed signup. These insights help identify where value creation breaks down—whether due to integration failures, misaligned onboarding, or gaps in model output quality.

By analyzing these metrics over time, teams can fine-tune both the customer journey and the pricing logic attached to it. You can surface accounts that generate high usage but low outcomes, then engage through success outreach or pricing realignment.

5. Connect Instrumentation to Revenue Operations

The last step involves integrating Moesif with your billing and RevOps stack. Billing meters can sync with Stripe to automate invoicing, while tracked outcome events populate dashboards for customer success teams. Moesif also lets you map outcomes to companies, users, and even sales stages through CRM or analytics integrations like Salesforce or Segment.

This full-stack visibility turns outcome metering into an operational system in addition to a metrics layer. With proper tracking, teams can support outcome-based pricing at scale: generating accurate invoices, surfacing product gaps, and aligning business outcomes with engineering execution.

Conclusion

Outcome-based pricing reframes how API businesses think about value. Instead of measuring activity, it encourages teams to track the results their product actually delivers—results that drive revenue, retention, and real-world impact. But achieving successful implementation and adoption of this model doesn’t require a complete overhaul on day one.

Start small. Identify one outcome that signals success. Instrument it. Moesif gives you the tools to capture those events, connect them to customer behavior, and pass the data to your billing system.

Whether you’re iterating on an existing model or launching a new one, Moesif helps you operationalize outcome-based pricing with confidence.